BOOKKEEPING

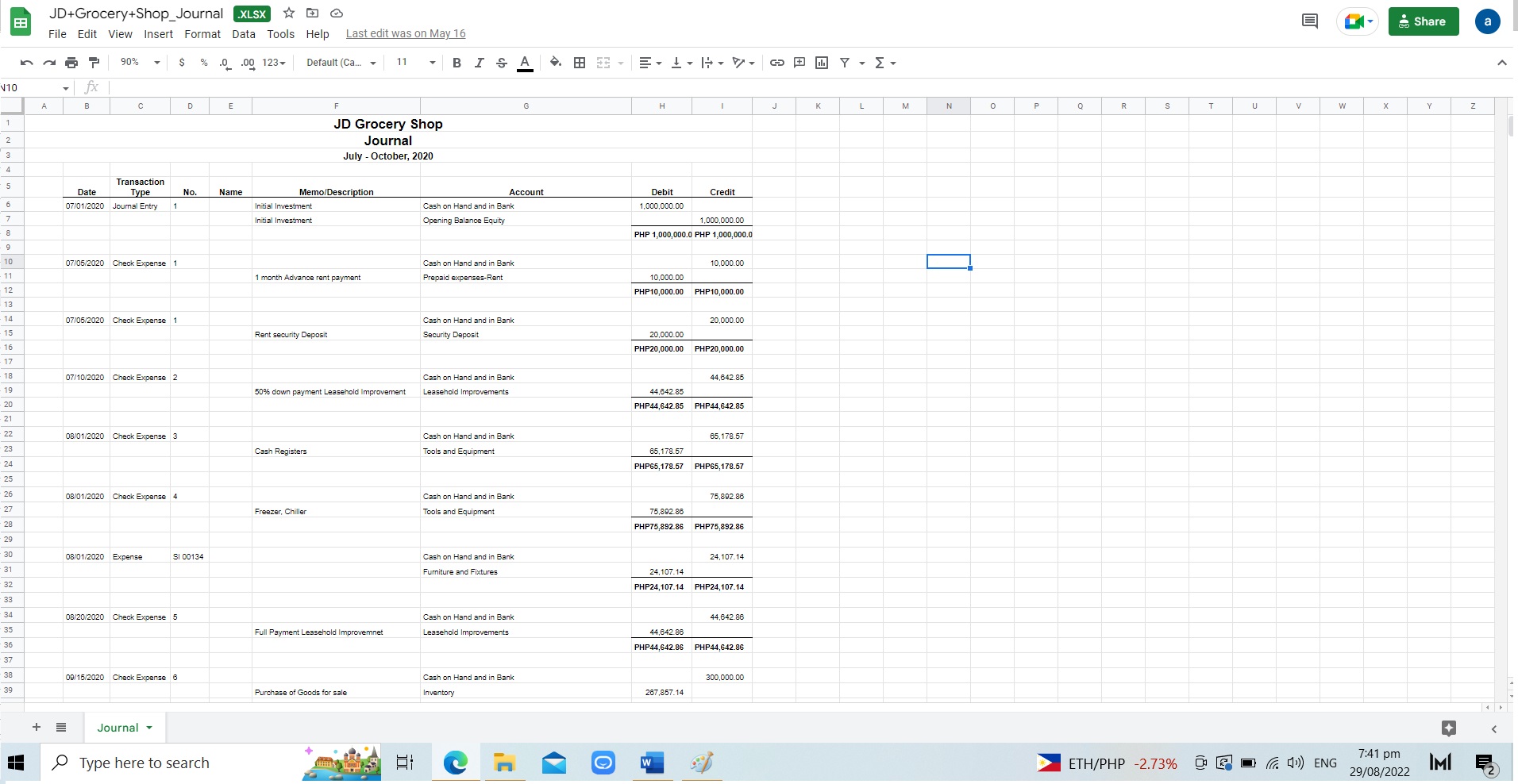

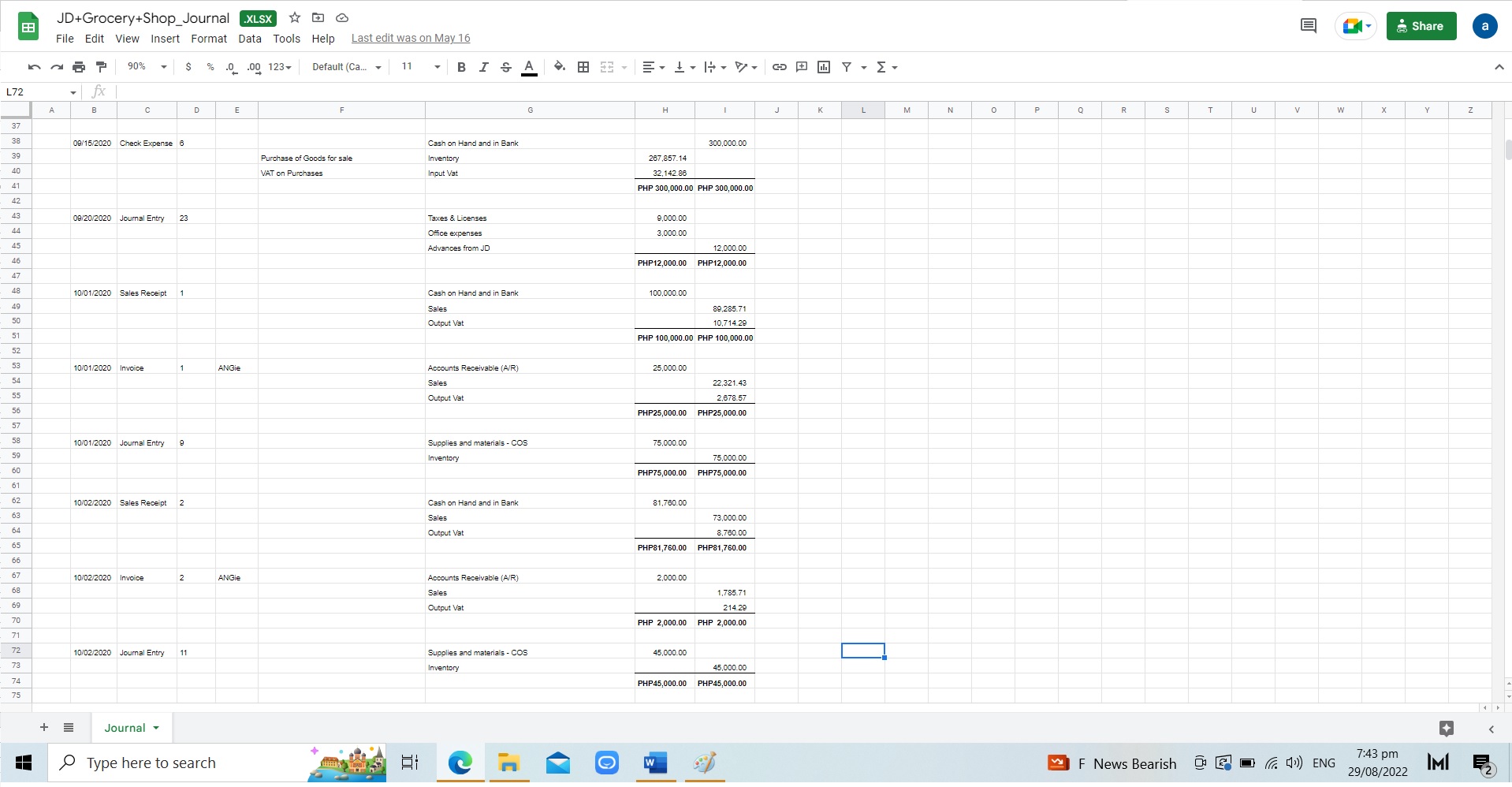

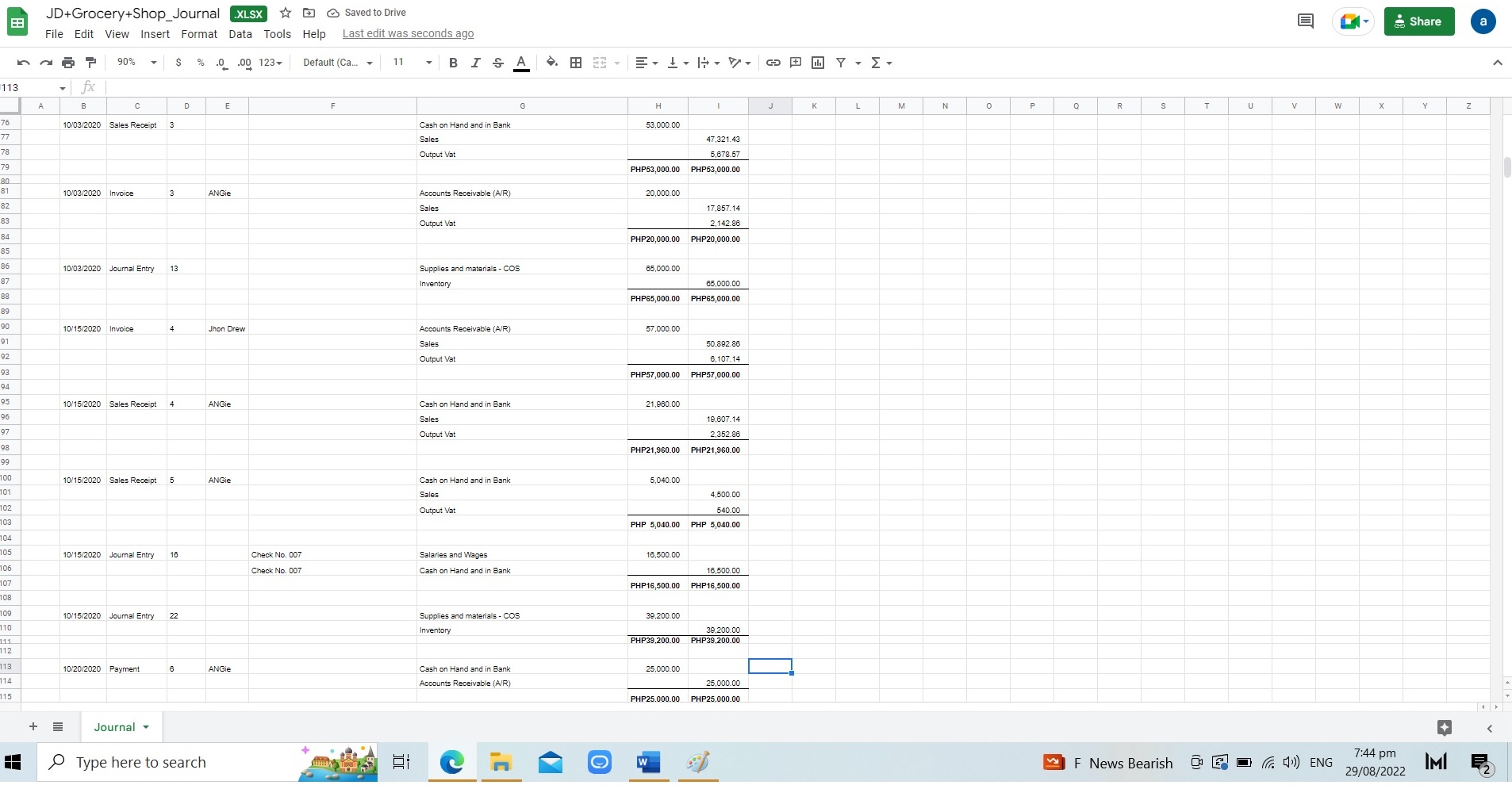

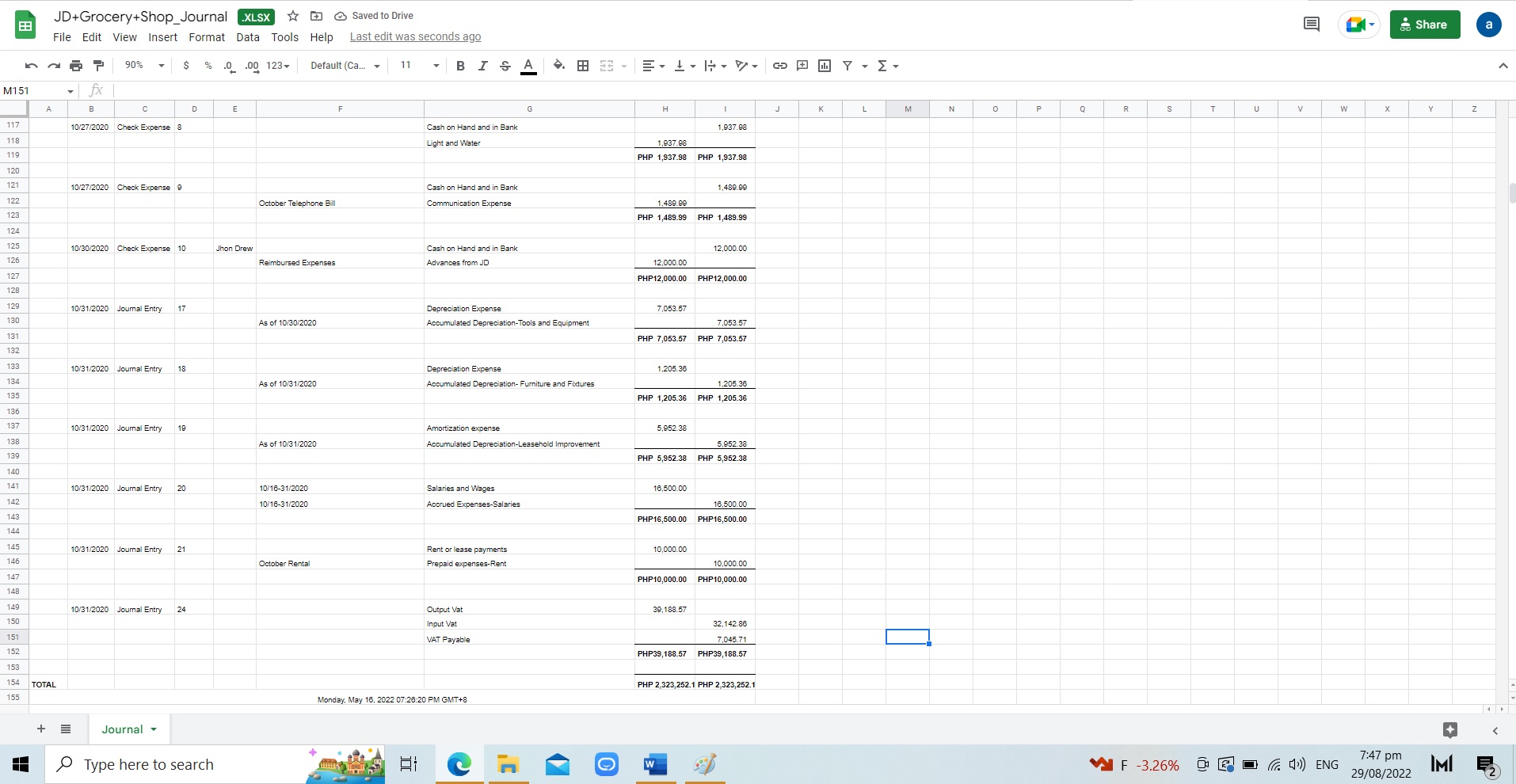

I have inputted the transactions in the QBO.

ALL CASH INVOICES (SI’s)- is recorded under Sales Receipt

ALL CREDIT INVOICES (CSI’s)-is recorded under INVOICES TabALL CHEQUES- is recorded under CHEQUES TAB

Other transactions will be under JOURNAL ENTRY(Capital investment, adjusting entries and all other transactions needed)

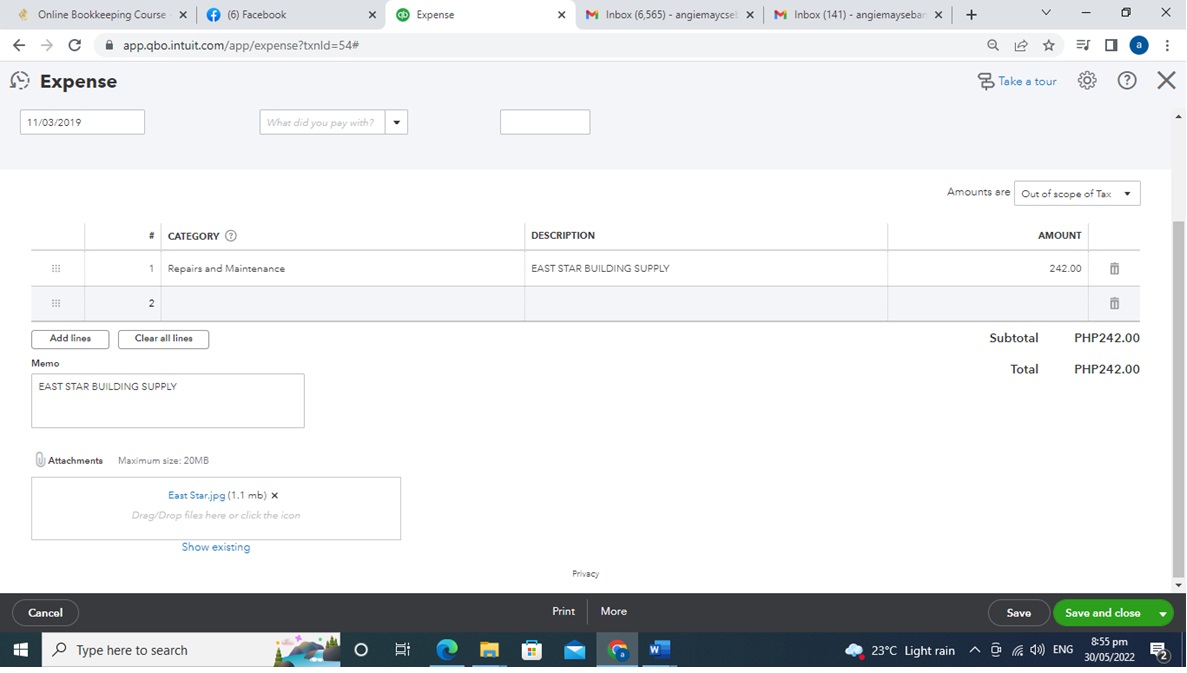

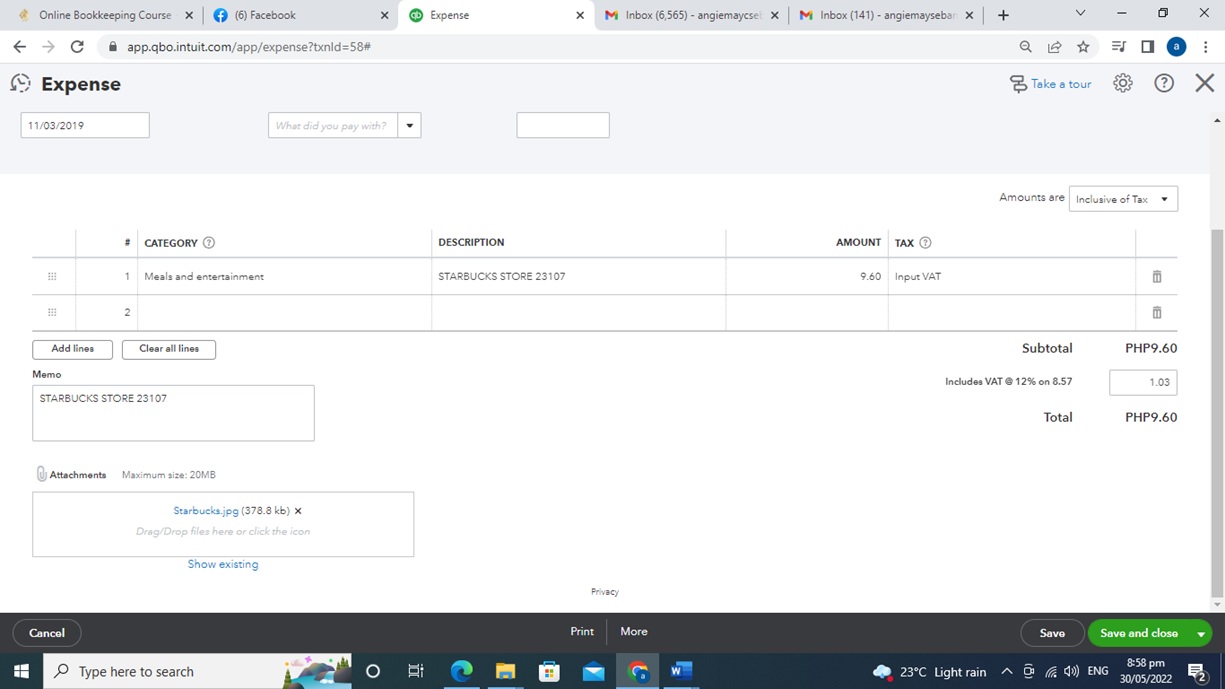

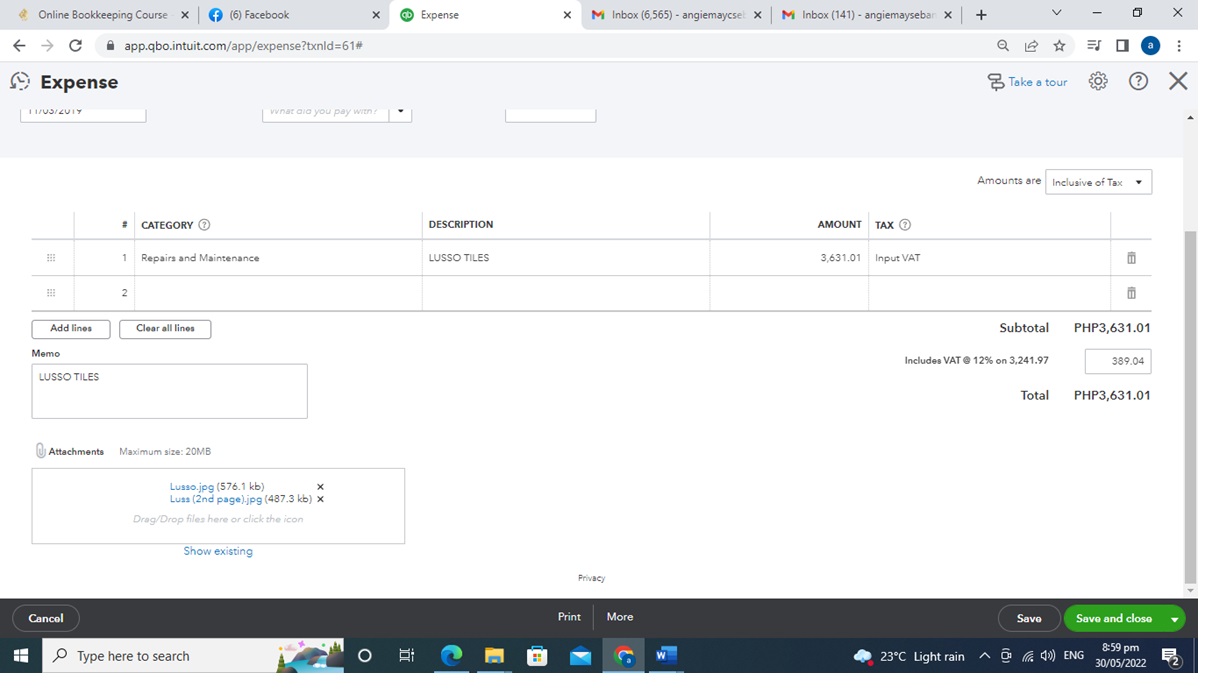

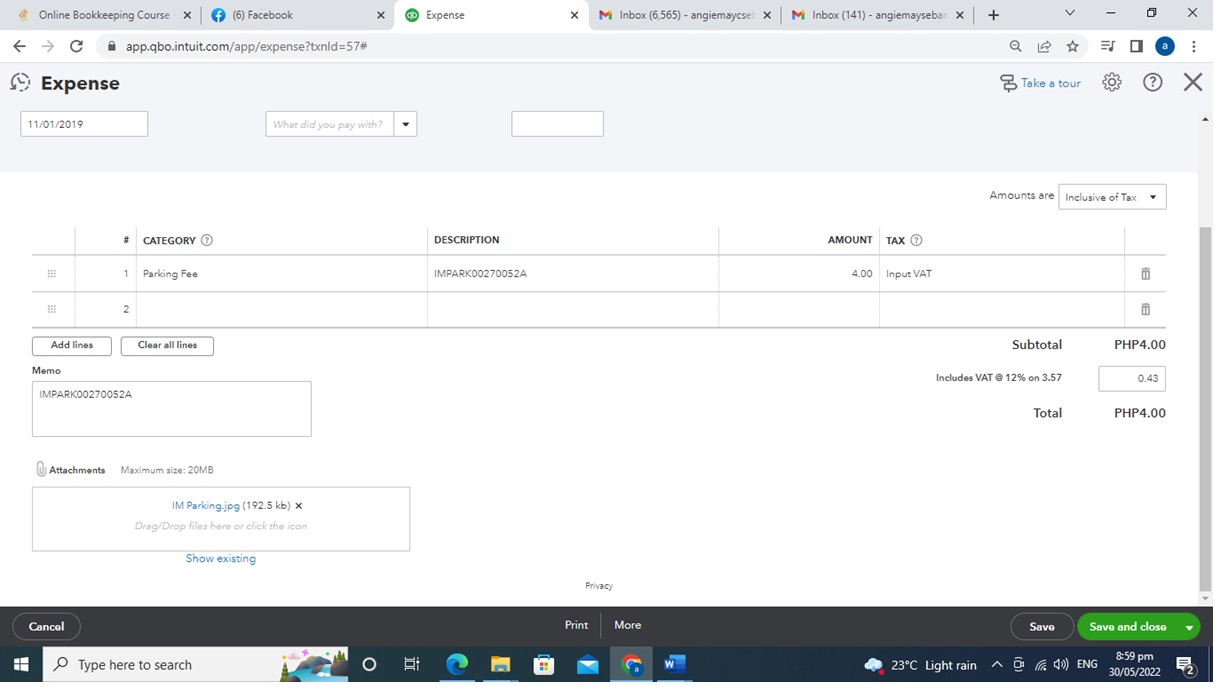

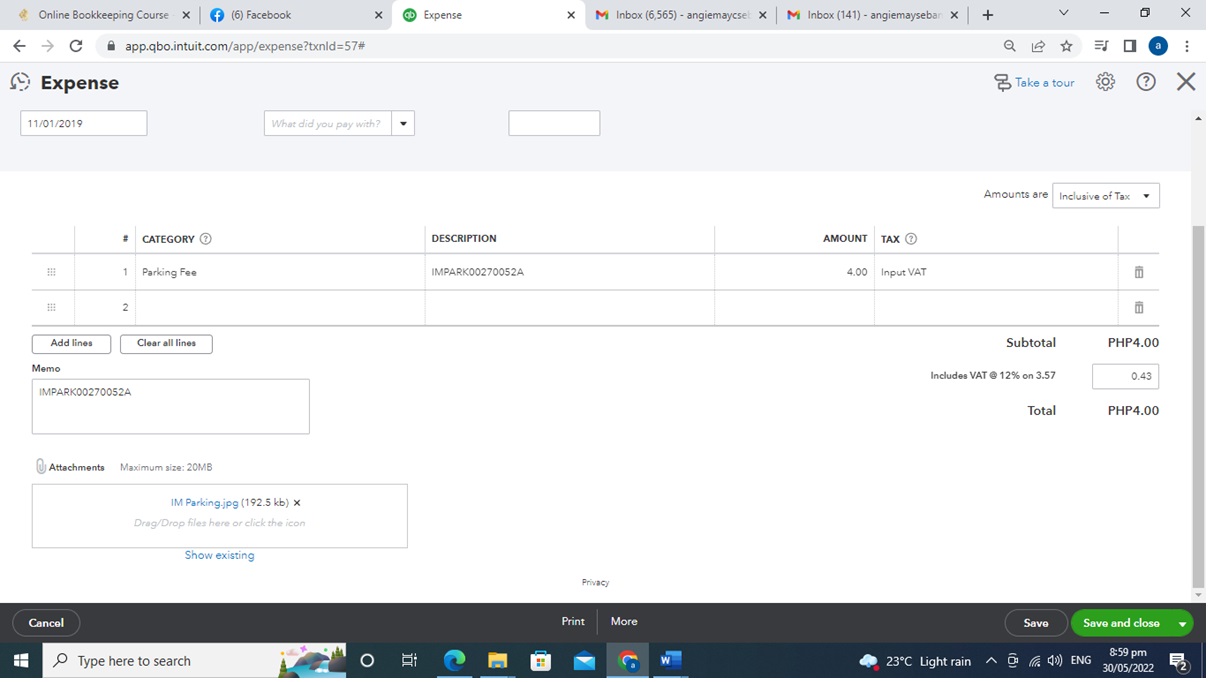

Set up TAXES (Input and Output Tax) and recognize them in the QBO.

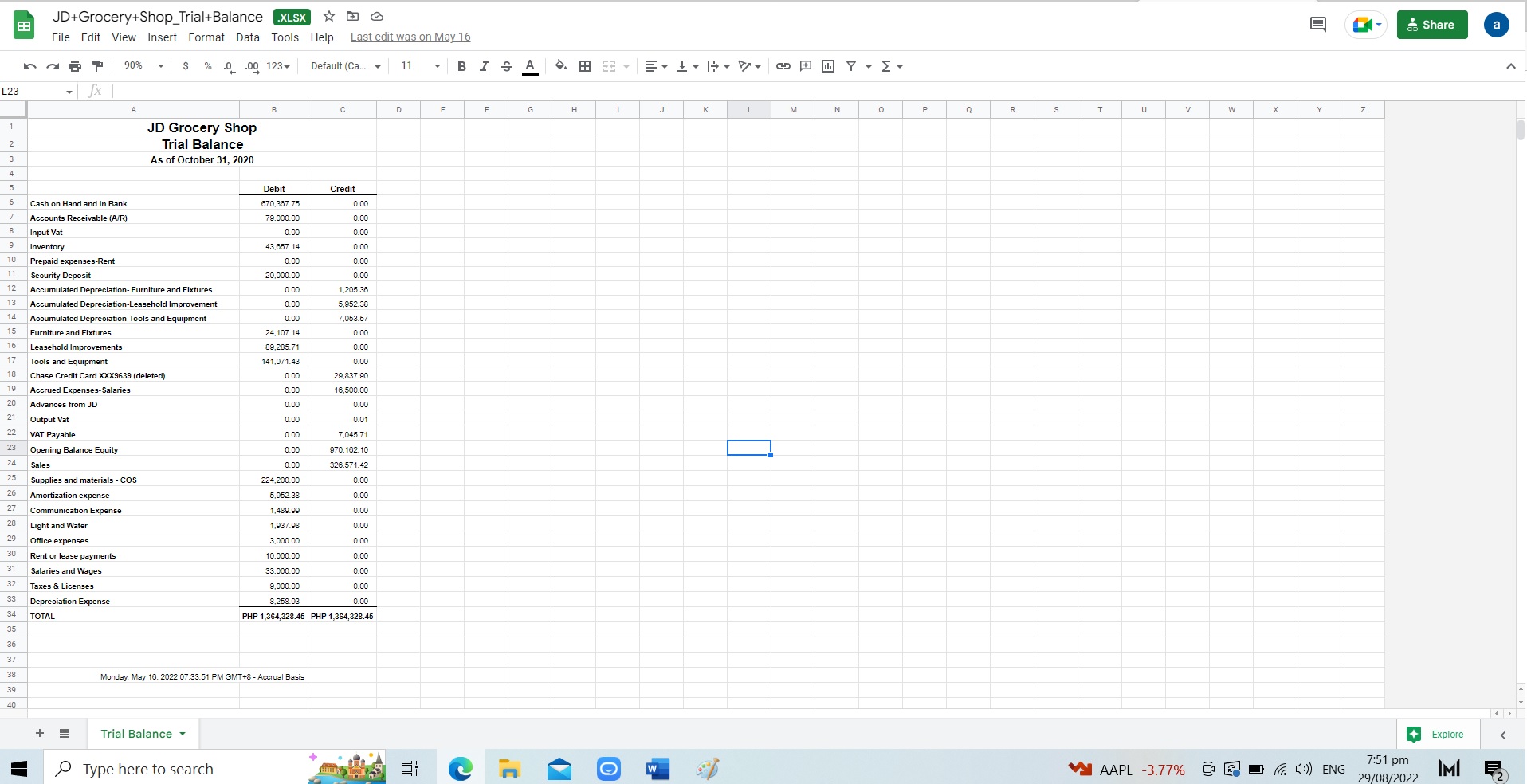

After recording all transactions in the QBO. I then generated the Financial Statements:

TRIAL BALANCE

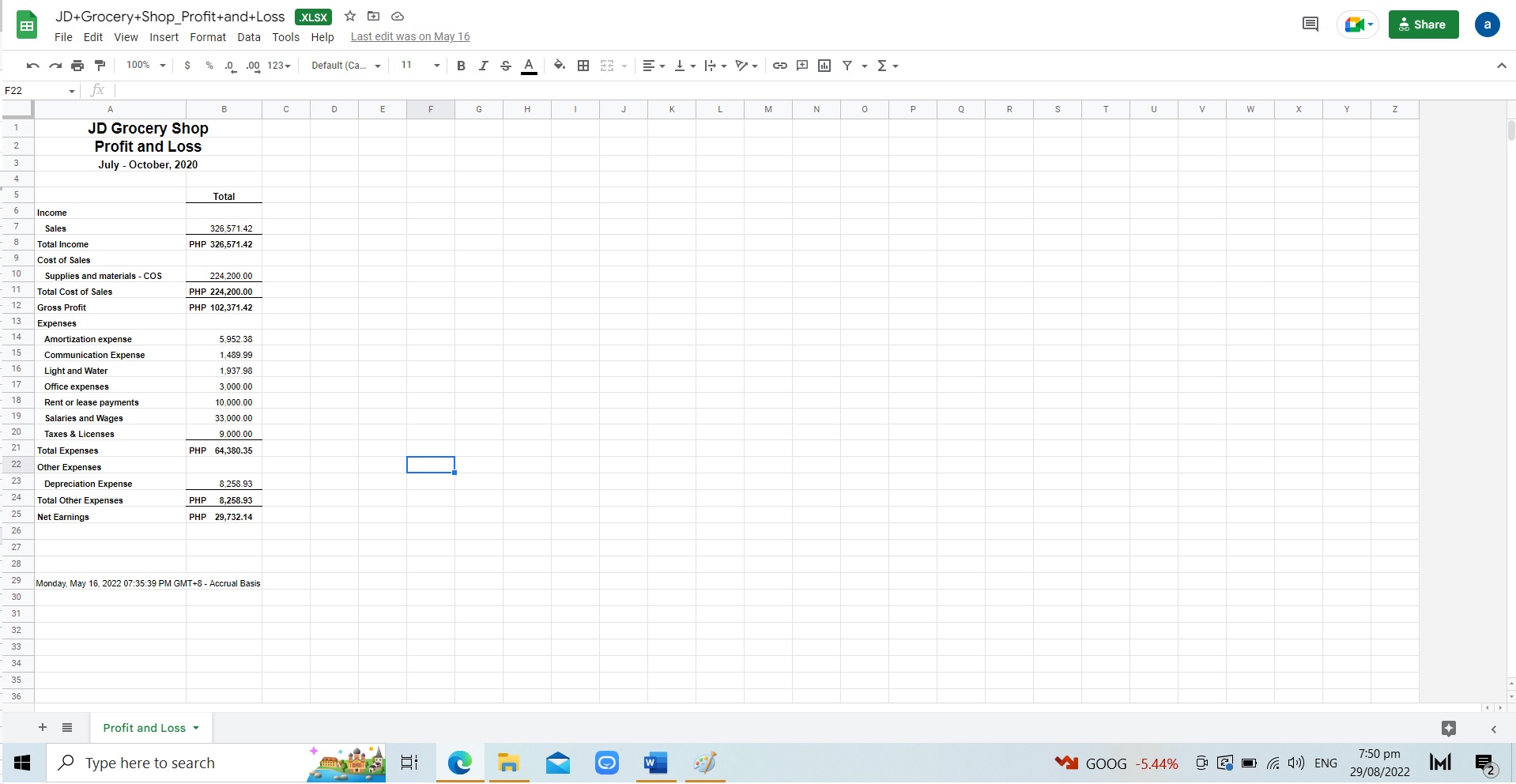

PROFIT & LOSS (P&L)

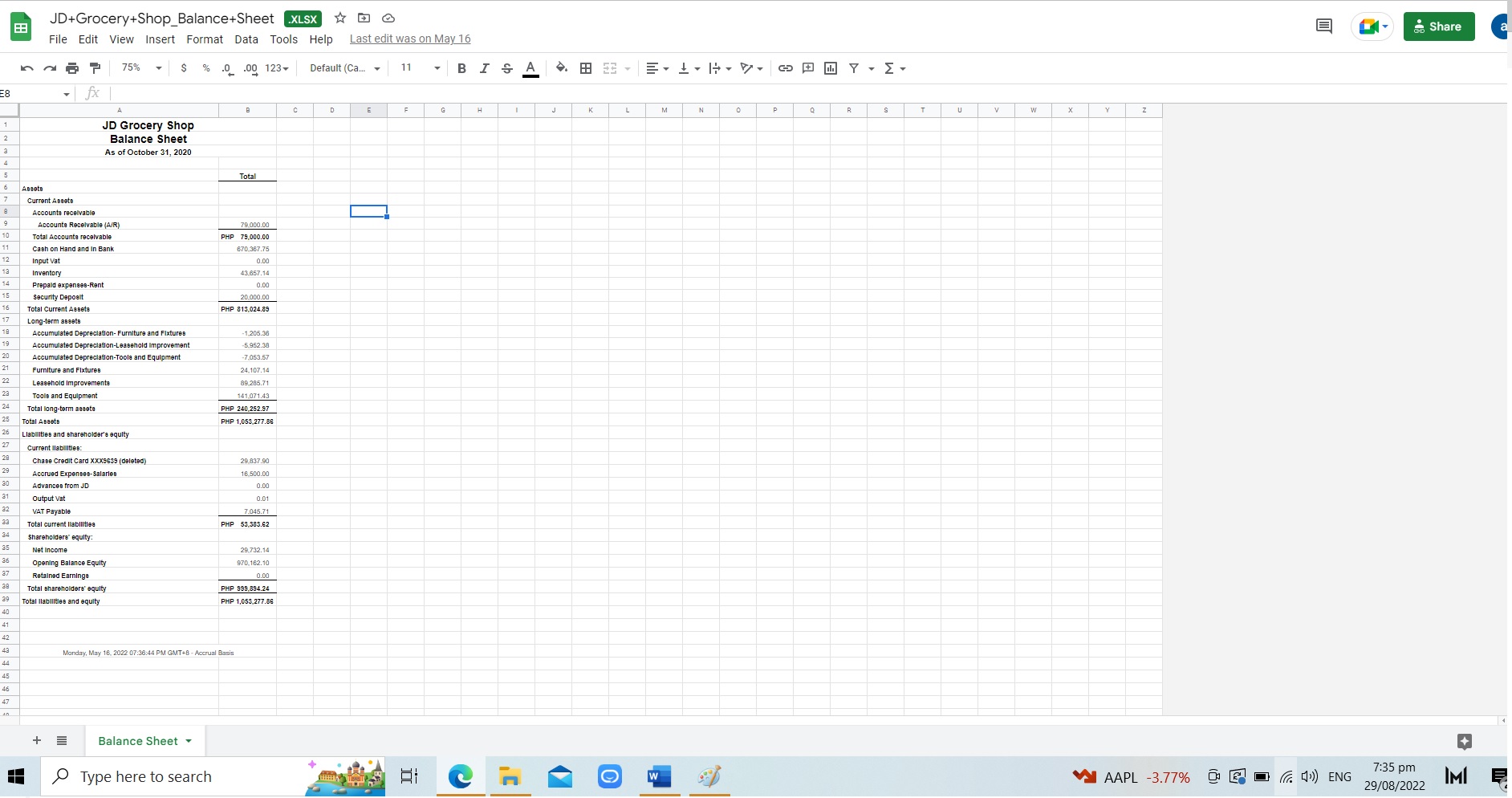

BALANCE SHEET

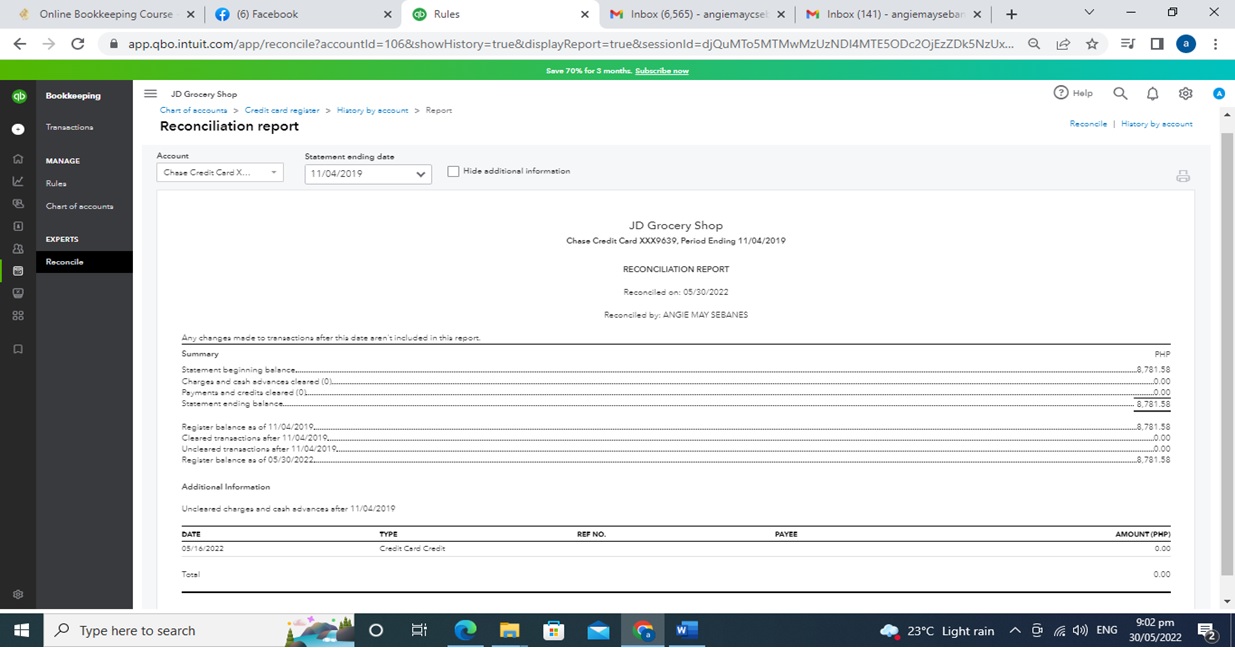

BANK RECONCILIATION

Receipts are recorded and attached in the QBO thru Expenses Tab